When the Cranes Come Down: Why Denver’s Building Boom Is at Risk

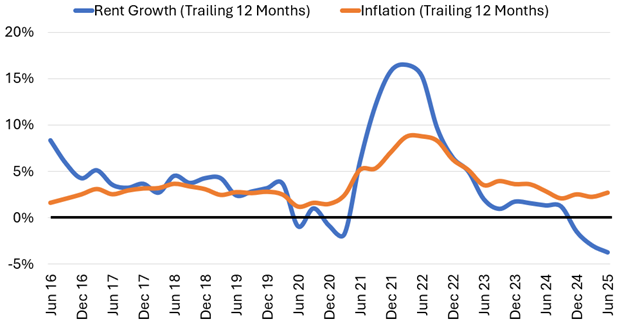

As housing affordability continues to be a headline issue across the country, the Denver metro area stands out one of the few markets in which rents have experienced an extended period of stabilization and, most recently, they’ve fallen. This positive development for renters is now at risk.

Many are surprised to learn that the average monthly rent in metro Denver ($1,816) was $95

cheaper in September than a year earlier, a decrease of 5%. More striking, today’s average rents are $25 lower than they were in June 2022, over three years ago.

The further one looks back, the more remarkable the trend in affordability. Since 2016, household income in the metro area has grown by over 6.4%annually. While the price of many other goods and services consumers buy have surged, average rents grew by just 4.5% per year over the same period.

Adjusting for inflation (i.e., the general increase in prices of ordinary goods and services), which has run about 3.4% per year over the last decade, rents in Metro Denver today are almost exactly where they were ten years ago.

Metro Denver’s resistance to escalating rents didn't happen because of a new law or regulation. It happened because of the most basic rule in economics: supply and demand.

Since 2021, Denver has completed and delivered 70,000 apartments, an 18% increase in total inventory, and rents have responded accordingly.

While welcomed by the city’s residents, this progress is now at risk. A "supply cliff" is

approaching, caused largely by well-meaning but harmful policies.

HOUSING IS A GAME OF MUSICAL CHAIRS

The housing market is like a game of musical chairs. The level of frenzy that occurs when the

music stops depends on how many chairs are available relative to the number of players.

The fewer the chairs, the more intense the competition for available seats; when it comes to

housing, that competition results in feverish bidding that drives up rents. When the supply of chairs is abundant, however, the frenzy abruptly ends. Players can relax and even pick and choose their preferred seat.

An abundance of rental housing supply is exactly what Denver renters enjoy today. How long that lasts depends on supply and demand going forward.

On the demand side, the Colorado State Demography Office reports that there are currently

80,202 eighteen-year-olds in Colorado, many of whom are getting ready to find their own places to live. Migration from around the country may also add to the demand.

If Colorado fails to continue adding enough places for its young adults and others moving here, the frenzy will resume – affecting not only the newcomers, but everyone in the rental market.

RISK & CAPITAL FLIGHT

Developers need to attract a staggering amount of capital - around $6 billion per year - to sustain the level of construction that has created the present renters’ market.

Contrary to the popular image of developers having endless cash, apartment builders can typically only supply around 5% of the funds needed to build housing. For the remaining 95% of the required funding, developers rely on global capital markets. Banks provide loans and outside investors provide equity capital.

The price at which lenders and investors make their capital available is directly tied to the perceived risk of the undertaking.

The riskier an investment, the higher the expected return investors and lenders require for the use of their capital. The higher the cost of capital, the higher market rents must be to pay for the construction of the new units.

If anticipated market rents cannot provide the required return on capital, the project does not just get more expensive, it gets cancelled. The cranes come down, and the supply of new homes dries up.

When the market is starved of new supply, bidding wars for existing apartments break out. Only once average rents across the market rise to a level sufficient to pay for the increase in risk will new construction begin.

REGULATION-DRIVEN INCREASES IN HOUSING COSTS

Capital flight is not just a theory; examples from around the country and the world abound. When St. Paul, Minnesota, passed a strict rent control measure in 2021, the number of permits for new multifamily buildings collapsed by 82% in just five months. In the Netherlands, policies intended to control costs led to a housing shortage that actually drove prices up.

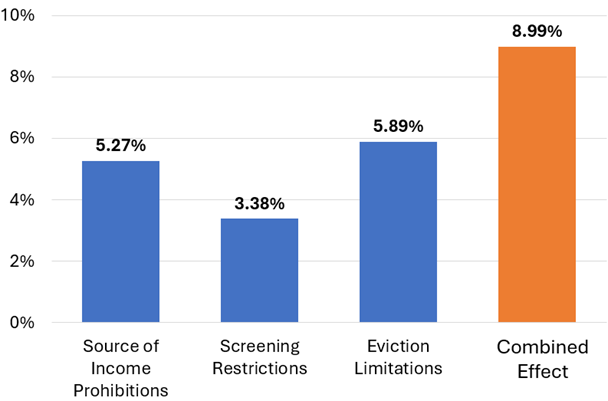

A recent study by MetroSight found that common regulations designed to protect residents, such as Source of Income Prohibitions and Eviction Limitations, resulted in increasing rents by between 3.4% and 5.9% when applied individually and by 9.0% when the policies were enacted together.

PROBLEMS AT HOME

Unfortunately, an observer need not look far to find an example of capital flight in progress.

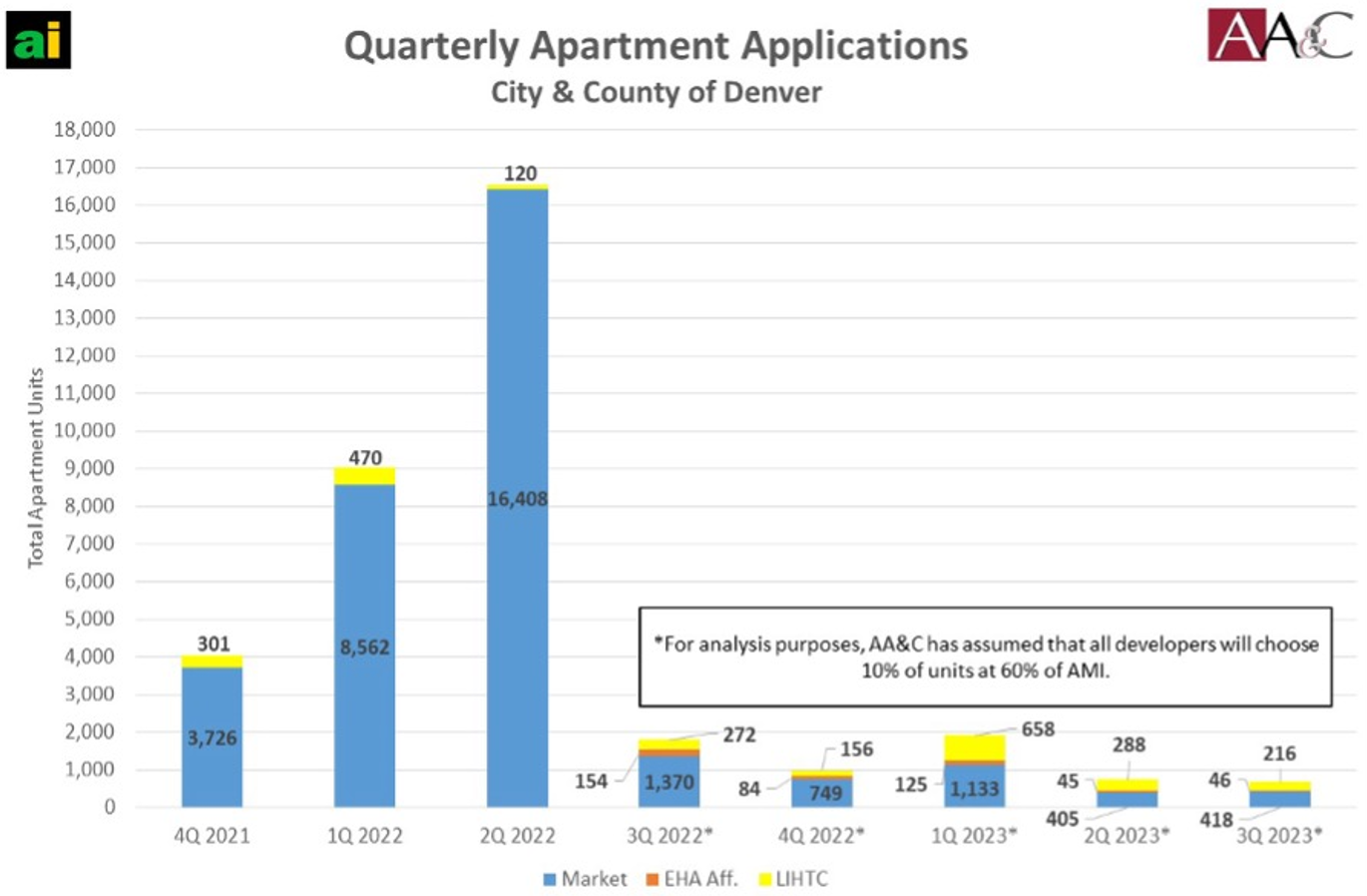

By requiring developers to set aside between 8% and 15% of new units as affordable, effectively offering them at a discount, Denver’s “Expanding Housing Affordability” (EHA) ordinance of 2022 reduced the ability of new properties to pay for the capital required for them to be built.

In 2023, Scott Rathbun, President of Apartment Appraisers & Consultants, showed that permit applications for market-rate apartments in Denver fell by 92% in the six months after the ordinance took effect on July 1, 2022. Permit applications fell to 2,119 units in the second half of 2022 as compared to 24,970 units during the first half.

While some of the pre-ordinance surge was undoubtedly attributed to developers rushing to file permit applications before the new rules took effect, the permit pace did not rebound. A full year after the implementation of the ordinance, developers filed permit applications annualized pace of just 864 units.

Rising interest rates in 2022 increased the cost of borrowing nationwide, creating significant headwinds for all real estate developers. However, Denver’s regulatory burdens amplified this national trend, pushing projects that were marginally feasible even in a high-interest environment completely into the red.

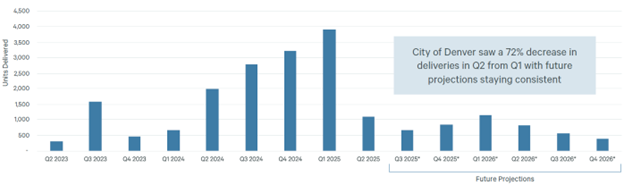

Because buildings take a long time to complete, the pipeline of projects permitted prior to mid-2022 continued to deliver new homes in Denver for several years. But that new supply buffer has been largely exhausted.

In Q2 2025, approximately three years after the ordinances and the rise in interest rates, the music stopped for Denver apartment completions.

A SUCCESS STORY AND A CAUTIONARY TALE

Over the past decade, and the past five years in particular, the amount of new supply flowing into Denver’s housing market has been a success story for housing affordability advocates. The collapse in new permits in 2022 and subsequent deliveries in 2025 demonstrate the fragility of that story and the risks both from internal and external forces.

While Colorado policy makers can do little about interest rates, pursuing thoughtful housing policy and creating a predictable regulatory environment is essential for attracting the billions of dollars needed to build new housing in Denver. This means avoiding the constant "legislative churn" of new rules and regulations that chases capital away.

Housing affordability will continue to be an urgent issue in Denver and across the country. If policymakers create a stable, predictable place to build, the capital that’s available for apartment development will flow into the city, the chairs will be built, and there will be a seat for everyone.