COLORADO’S FUTURE: The Impact of an Aging Workforce

There’s No Quick Fix For Current Hiring Problems,

But More Flexible, Adaptable Employees And Teams Could Play A Role.

In the coming years, mature and older workers will play an increasing role in Colorado’s workforce.Between 2010 and 2040, the category of Coloradan workers over the age of 54 is expected to grow from 1 in every 5 workers, to nearly 1 in every 4. Although Colorado is not unique in facing this changing dynamic, the impacts of the pandemic and the continued labor force shortages have only sharpened the focus of needing a sea change approach to both public and corporate policy to harness the full benefits of the aging workforce.

As a result of the COVID-19 pandemic, Colorado is facing an even more significant labor shortage. While the state has struggled to find enough skilled workers for several years, there are more than 149,750 job openings according to Connecting Colorado, a partner of the Colorado Department of Labor and Employment. To meet the labor demands, Colorado must retain and hire skilled workers, especially mature and older workers who are willing and able to work but struggle to find a job or stay employed because of their age.

Projections from the Bureau of Labor Statistics from October 2021, estimate that the labor force participation rate (LFPR) for Americans over the age of 65 are expected to grow, including an increase of 6 percentage points in the LFPR for individuals 65 to 69. This is a much larger increase than the projected 2.8 percentage point increase for workers 55 to 59. Adding to this picture is inflation running at the highest point in forty years, which will undoubtedly figure into older workers’ decisions to remain employed, retire, and for those who have left the labor force, to re-enter the labor force. Older workers whose income is based on social security, fixed annuities, and retirement savings will be incentivized to go back to work to offset the reduced purchasing power due to high inflation.

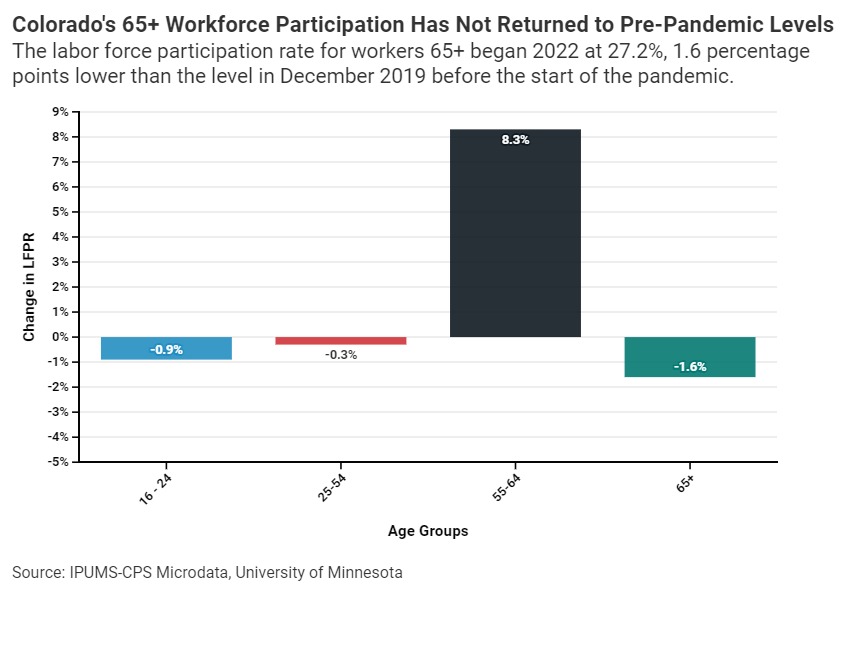

Workers 65 years and older will grow by about 150,000 between 2019 and 2040. Colorado is catching up to the national trend of an aging workforce, driven by increased lifespans and preferences to work longer, combined with a smaller cohort of younger workers coming up behind. By 2034, it is projected that older adults will outnumber children for the first time in U.S. history as all baby boomers will be 65 years or older by 2030 The effects of the pandemic on the mature workforce have been especially pronounced for workers 65 years and older. The overall Colorado labor force participation rate has rebounded to pre-pandemic levels. However, it is down by almost two percentage points for workers 65-years and older. In December 2019, the labor force participation rate was 28.8% for 65-years and older workers. But, in January 2022, it fell to 27.2%. The drop in the labor force participation rate for workers 65-years and older remains a concerning trend.

While there are indications the trend for older workers will improve in the coming years, the longer it takes, the more workers who are otherwise willing, able, and interested in continuing to work will instead remain outside of the labor force.

83% of global business leaders realize the benefit of multigenerational workforces.

Only 74% agree that they would provide training and lifelong learning opportunities for older employees if given the appropriate information to do so.

A 2020 survey conducted by Transamerica Center for Retirement Studies, found that “one in five workers (21%) indicate their confidence in their ability to retire comfortably has declined in light of the coronavirus pandemic – and only 27 percent are very confident that they will be able to fully retire with a comfortable lifestyle.” The spike in inflation exacerbates the low levels of confidence to retire comfortably even more. Those whose income is based on social security, fixed annuities, and retirement savings will be incentivized to go back to work to overcome the reduced purchasing power they have been faced with. As a result, some Coloradans may choose to remain in the workforce, due to a fear of insufficient savings to retire. While others may choose to stay because of the fulfillment they get from working and contributing to the economy, to maintain their health or to stay connected with their communities.

According to the 2020 AARP study “Insights from Global Employers: The Future of Work is Living, Learning, and Earning Longer,” 83% of global business leaders recognize that multigenerational workforces are key to growth and long-term success of their companies. Multigenerational workforces are workplaces that employ people of all ages, allowing for innovation, collaboration and learning opportunities for all employees.

Acknowledging the skills, experience, and knowledge that older workers can bring to the workforce is an important first step in adjusting to the ongoing demographic shift. However, the same AARP survey indicated that global business leaders have not adopted internal policy changes to the same degree they recognize the opportunity and productivity impacts of doing so. Of the employers surveyed, 74% agreed that they would provide training and lifelong learning opportunities for older employees if they were given the appropriate information on how to properly implement a program. As of December 2020, only 6% already had unbiased recruitment processes in place.

THE ECONOMIC CONTRIBUTIONS OF COLORADO’S AGING WORKFORCE

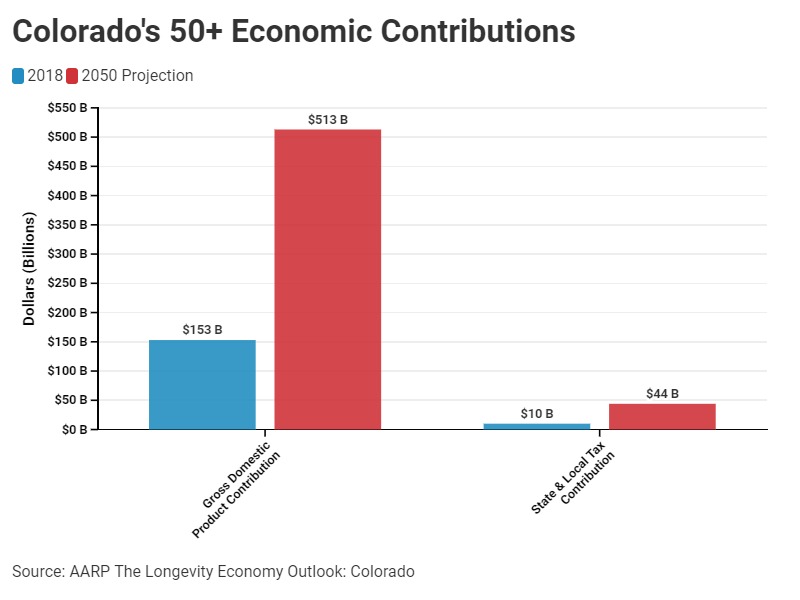

The importance of Colorado’s aging workforce should not be overlooked. According to a 2018 AARP study, “The Longevity Economy Outlook: Colorado,” the 50 years and older population will continue to drive economic growth for the next 30 years. Using Regional Economics Models, Inc. (REMI), the AARP study found in 2018 that Colorado’s 50 years and older population contributed $153 billion towards the state’s total Gross Domestic Product (GDP), equivalent to 40%. In the same year, this population’s market activities supported $10 billion in state and local taxes, 36% of total taxes. The economic impact of the aging workforce is expected to increase to $513 billion or 42% of GDP and $44 billion or 41% of state and local taxes by 2050. With the labor force participation rate still down from pre-pandemic levels, there is potential for lost economic benefits and contributions if the participation rate does not recover.

In 2018, 50 years and older households were accountable for 53 cents of every dollar spent in Colorado but were only 33% of total population. By 2050, when the 50 years and older account for 41% of population, they will account for 61 cents of every dollar spent, an 8% increase. The economic contributions that the 50 and older population provides are significant and will only grow in the future.

It is necessary for employers to acknowledge the importance of the aging workforce and its contributions. Adapting to the aging workforce and its needs, as well as the needs of employers for skilled and experienced employees, will be beneficial to Colorado’s economy. Providing flexible schedules, more comfortable work environments and letting go of age biases and discrimination will allow the aging workforce to remain active in the economy and ensure access to talent every employer needs. Subtle workplace changes are just the beginning of catalyzing changes for the aging workforce.

THE PATH FORWARD: POLICY CONSIDERATIONS TO CATALYZE CHANGE

To remain competitive, employers should expedite the changes needed to capitalize on the aging workforce. Most states are in a labor shortage due to the pandemic. For Colorado to stay at the forefront, Colorado employers will need to adopt changes to better adapt to the demands of the aging workforce.

Many businesses and government agencies have been aware of the pending demographic shift and are working to implement changes. However, greater awareness and action is still needed. It will take time, effort, evaluation, and informed management teams to tackle the transition into a workplace suitable for all age groups.

Public Grants to Adapt

Public grants could be a useful tool for adjusting the workplace to accommodate the increase in the ageing workforce. Kansas, New Hampshire, and Singapore have implemented successful public funded programs that help ease the uncertainty of how to get started.

In 1996, the Kansas Department of Aging launched the Older Kansas Employment Program (OKEP) designed to provide employment placement services to Kansans 55 years and older. In 2017, over 2,400 older adults were served through this program. OKEP is funded by the Kansas legislature through a state grant and the Kansas Older Worker Taskforce recommends and allocates the funding. In fiscal year 2019, OKEP received over $500,000 in funding and the state of Kansas determined a three-fold return on investment measured by the increase of wages to participants in the program. According to the Older Kansans Employment Program Fiscal Year 2019 Annual Report, “for every $1 spent on the OKEP program, $3.23 of income and sales tax was returned to the state of Kansas.”

New Hampshire launched a two-year grant program in 2018 known as the New Hampshire Works Mature Worker Program (NH Works). This program specializes in individualized re-employment services and training opportunities to workers 55 years and older. NH Works is funded by and partnered with the U.S. Department of Labor, New Hampshire Department of Business and Economic Affairs, and Office of Workforce Opportunity. The program provides employers a retention incentive of up to $4,000 once the eight months of employment is completed by a participant of NH Works.

Singapore launched a public grant program in 2013 known as the WorkPro Program. The program was enhanced in 2016 to better support companies looking to implement age-appropriate workplaces, practices, and training. The program consists of three grant options: the Age Management Grant, the Job Redesign Grant, and the Work-Life Grant. The grant options are meant to incentivize actions to be taken to accommodate the workplace for the older working population. The grants vary in the specific areas they focus on ranging from well-being and health to safety, job redesign and flexible work arrangements. According to Josephine Teo, Singapore’s Minister of Manpower, in the first four years of existence, the WorkPro Program has benefitted over 3,400 companies employing about 368,000 workers.

Tax Incentives

Another opportunity would be to utilize tax incentives for employers that hire, retain and train aging workers. As The Bell Policy Center noted, these tax incentives “should be paired with strong evaluation mechanisms and targeted to support workers in selective areas, industries, and those more likely to face discrimination.” Colorado already has the Worker Opportunity Tax Credit (WOTC) which incentivizes employers to hire a specific group of individuals.

As of now, the targeted individuals are welfare recipients, veterans receiving food stamps, disabled veterans, ex-felons, designated community residents (high risk youth), vocational rehabilitation recipients, supplemental security income recipients, long term Temporary Assistance for Needy Families (TANF) recipients, and unemployed veterans. If the WOTC added older workers (65 years and older) as a targeted group, this would benefit employers and address the demographic issues Colorado’s workforce is facing. Employers would benefit from hiring these workers, providing supplemental training, and earning a tax credit for doing so.

Education and Workforce Training

Education and Workforce Training

The focus on the aging workforce has a dual purpose of supporting older workers that remain employed, but also allows them to adapt to the changes in the job market and demand for different skills and credentials.

Another program for accommodating to the aging workforce’s needs is BMW’s Today for Tomorrow program. This production line program was piloted in Dingolfing, Southern Bavaria in 2017. BMW realized that its workforce is aging and that changes to the production line were necessary to keep their employees happy and healthy. The managers of the BMW plant decided to implement minor changes: “better seats, new workbenches that could be adjusted to an individual’s height, wooden flooring that provided better cushioning and insulation.”

When the BMW managers implemented the workplace changes, they also assigned a mix of younger and older workers to operate next to each other at a regular production pace of 560 gear boxes per day. After three months of the mixed production line and subtle workplace changes, BMW found that the mixed age production line productivity improved by 7%, the initial absenteeism rate decreased by half, and the defect rate dropped to zero.

COVID federal relief funds could be a way of funding the necessary workforce training and learning opportunities for aging workers. Catalyzing employers to educate and train their older workers would benefit Colorado’s economy, older workers, and employers.

The Aging Workforce Initiative (AWI) is another example that Colorado could reference and expand on for training and educational purposes. AWI is a program that was made with the intent to help employers more easily assist with the needs of the aging workforce, specifically workers 55-years and older. The program is funded by the U.S. Department of Labor’s Employment and Training Administration. The program focuses on using grants to help build a better capacity for the workforce to assist the older individuals and to help the older individuals learn model skill development. In AWI, the companies selected to receive the $1 million grants were responsible for targeting a few key areas that are listed in the Solicitation for Grant Applications. The specific areas ranged from training techniques to self-employment to enhancing already learned skills and targeting more needy older worker subgroups.

Such a program would focus on older adults training and education and could be funded by the state and implemented in Colorado. The grants could go to five to ten Colorado communities throughout the state ensuring rural, mountain, plains, and the Denver Metro Area were included. This would utilize the lessons learned from AWI and apply them to the Colorado program, provide further enhancements that would, equip older adults with the ability to evolve and adapt to the changing skill sets and knowledge needed to continue work thus expanding the talent pool for employers to draw from.

A Policy Shift to Phased Retirement Options

Colorado employers could continue to access decades of mature talent by creating more phased retirement options that allow an employer to gradually reduce hours worked for the aging workers. This would allow older experienced employees to mentor younger talent as well as maintain corporate productivity and revenue generation. Colorado could utilize part-time work, seasonal work, volunteer work, and job-sharing to incentivize the aging workers to remain in the workforce and take advantage of a phased retirement plan.

For some older adults, staying engaged in the workplace in a capacity less than full-time would allow them to continue working for as long as they want to. The concept of phased retirement allows aging workers to reduce their working hours as they start their transition toward retirement. A phased retirement program in Canada allowed workers to decrease their working hours and receive a portion of their pension benefits from employer-sponsored pension plans. These same workers were still allowed to accrue pension benefits in the same plan as they were collecting benefits and still working. Although Colorado could not implement this exact program, it is important for the state and its businesses to acknowledge the abundance of options for phased retirement plans that could be replicated.

Recent Legislation – 2021 and 2022 Legislative Session

One factor that can impact an older adult’s decision to keep working is how retirement income is treated for tax purposes – that is, whether an older adult is penalized for earning more income by reducing benefits from existing retirement streams.

In 2021, Colorado passed HB21-1311. Before this bill was signed into law, taxpayers aged 55 to 64 could deduct a limit of $20,000 of pension and annuity income, including federally taxable social security income, when calculating their taxable income in the state of Colorado. While Coloradans aged 65 years and older could deduct up to $24,000 when calculating their taxable income. However, with the passage of the bill, beginning in 2022 the limit was raised so that all federally taxable social security income could be deducted. The limits still apply to all other forms of pension and annuity income. Policy that would reduce caps on other forms of pension and annuity income would increase older adults’ willingness and interest in staying in the workforce longer.

In the 2022 legislative session, HB22-1101 would expand a program that is set to expire in July of 2023. The program “allows a public employees’ retirement association (PERA) service retiree to work full-time without any reduction in the service retiree’s retirement benefits for a rural school district that has a critical shortage of qualified individuals with specific experience, skills, or qualifications that the service retiree has.” The bill would make this program permanent, add school nurses and paraprofessionals to those eligible for post-PERA retirement full-time employment and allow charter schools or a board of cooperative services to participate in the program that are in a rural school district. Given the extreme shortage of teachers in rural areas, this policy would benefit the education system, older adults seeking work, children, and the economy. HB22-1101 has passed out of the legislature and is waiting for Governor Polis’ signature.

HB22-1057, Public Employees’ Retirement Association (PERA) Employment After Teacher Retirement also aims to decrease the stress of substitute teacher shortages the state is facing. Without this bill, PERA “limits the number of days that a retired teacher can work as a substitute teacher.” HB22-1057 would temporarily remove the limits that exist for qualified service retirees in any school district or charter school. This bill has passed out of the Colorado legislature and is waiting for the Governor’s signature.

Another bill focused on the aging workforce is HB22-1035, the Modernization Of The Older Coloradans’ Act which proposes several updates to the “Older Coloradans’ Act.” The bill is seeking to reorganize the Colorado Commission on Aging to involve more older Coloradans voices, appoint a representative from the Colorado Department of Human Services to be a liaison for the Commission, and create a technical advisory committee of state agency representatives to oversee the implementation of the strategic plan. HB22-1035 has passed out of the legislature and is awaiting the Governor’s signature. The second bill in the current legislative session is HB22-1209, Sunset Strategic Action Planning Group On Aging. The bill would “implement the recommendation of the department of regulatory services’ sunset review and report concerning the strategic action planning group on aging by repealing the group.” HB22-1209 remains under consideration in the Colorado legislature.

Policymakers could also get involved in strengthening and fine tuning the age discrimination laws that exist in Colorado’s workforce. As The Bell Policy Center noted in their “Actionable Aging Policy Agenda,” policymakers should update age discrimination laws, so employers are required “to remove age-identifying information on applications; increase compensation for victims of age discrimination; and mirror the introduced federal Protecting Workers Against Age Discrimination Act.” Implementing these changes in workforce laws would make aging workers more comfortable in the workplace and provide a more inclusive environment for all employees.